Digital connectivity

China’s government has long considered the internet essential infrastructure to upgrade its industry, boost competitiveness and for potential military uses. A combination of industrial policy, protectionism and entrepreneurship have led to the establishment of important telecommunications companies – chief among them, Huawei.

China was an early mover in 5G, currently the most modern mobile connection to the internet. Huawei and ZTE took part in early standardization meetings on 5G, and China deployed 5G in 2018, before most Western countries started their roll-out. Huawei’s technology rivals that of established equipment suppliers Nokia and Ericsson and is usually cheaper.

Now, the world is watching 6G, for which 2025 will be an important year. Huawei is already set to play an important role in this future key technology.

China’s strategy of building infrastructure first, assuming demand will follow, has worked very well especially in mobile and broadband internet. In disruptive internet technologies, this strategy is not possible. For instance, Chinese companies still trail the US satellite internet provider Starlink, which pioneered low Earth orbit (LEO), high-bandwidth satellite internet. China launched the first satellites in 2024 for Qianfan, an eventual globe-spanning internet network to rival Starlink, one of three networks intended to be operational in China by 2025.

Other technologies have seen less innovation in recent years but are still a focus of US-China tech competition. Submarine communications cables, for instance, have an average life cycle of 17 years, with recent innovation mostly focused on cost effectiveness. Since most traffic passes through submarine cables, both the US and China are wary about spying, and have thus competed for the location and control of many of these cables.

At a glance

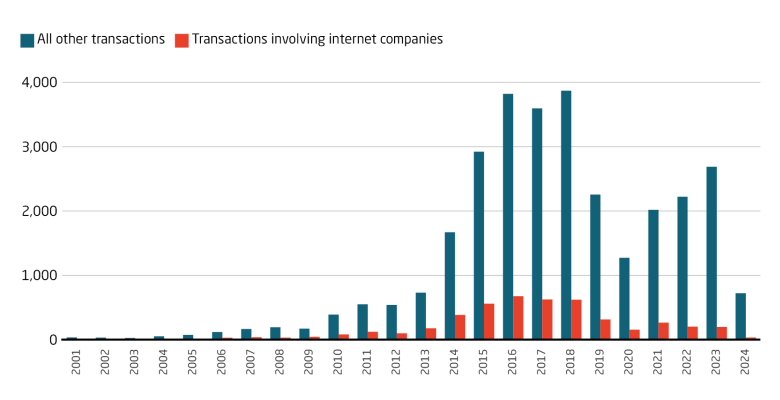

Between 2014 and 2018, many Chinese startups offered internet-based services, like the Internet of Things. With China’s tech crackdown of 2020-2021 and the reorientation of the economy toward the “real economy,” fewer startups focused on providing internet-enabled services.

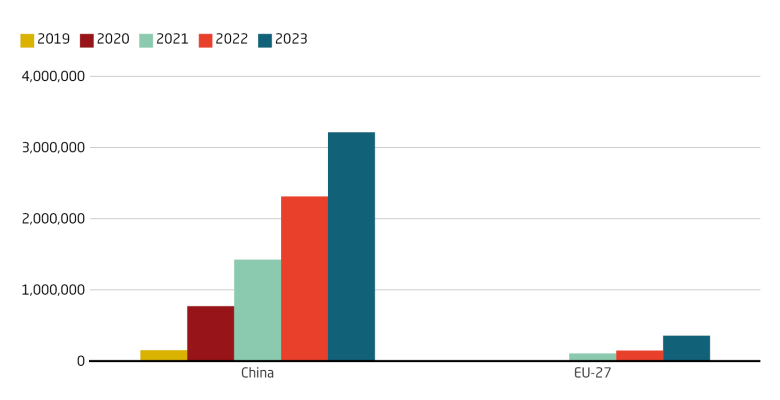

China deployed 5G more quickly and comprehensively than any other jurisdiction. Expecting that demand would follow, China very quickly built out 5G capacity, and 5G subscribers followed more slowly. In 2023, China had the largest number of 5G base stations of any country.

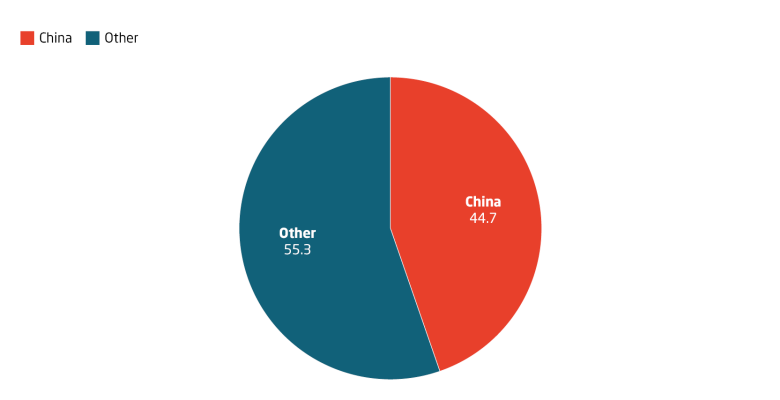

FiberHome Telecommunication Technologies Co., Ltd. and Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC) control a combined 19 percent of the world’s fiber-optic cable market. They are based in Hubei province’s “Optics Valley of China,” where optoelectronic firms receive research and development (R&D) subsidies, tax rebates, awards for patents and standards, recruitment grants and more industrial policy support.

Digital Connectivity in China: Timeline of crucial events

China's Big Three state-owned telecommunication operators (China Mobile, China Unicom and China Telecom) launch 5G networks in China, almost nine months before the launch of 5G in Europe.

China establishes the SOE China Satellite Network Group (SatNet) to drive the internet satellite megaconstellation GuoWang (China Satellite Network), China's state megaproject for satellite internet.

NDRC launches "Eastern data, Western computing" megaproject to make China’s computing power infrastructure more efficient &sustainable, moving data processing to inland provinces with cheaper land.

Huawei presents 5G-Advanced (also called 5.5G) at the Mobile Broadband Forum in Doha. 5G-A is an innovation between 5G and 6G. Huawei was the first to develop a complete product portfolio for 5.5G.

National Research Centre of Parallel Computer Engineering and Technology (Wuxi) discloses details on supercomputer Sunway OceanLight, built despite US sanctions, may be one of three exascale machines.

China Mobile conducts the world's first low earth orbit (LEO) satellite test using 6G technology, driving forward its plans for an integrated terrestrial-space network with high speed and low latency.

A team from Beijing University of Posts and Telecommunications says it has built the world's first 6G field test network, an important step toward commercialization which Beijing wants by 2030.

China submits two spectrum allocation filings to the UN’s International Telecommunication Union (ITU), revealing plans for a megaconstellation of ca. 13,000 internet satellites.

The powerful Central Commission for Cybersecurity and Informatization publishes Beijing’s most important strategic blueprint for the digital transformation, the 14th Five-Year Plan (2021-2025).

Second Institute of China Aerospace Science and Industry Corporation (CASIC) tests real-time wireless transmission using terahertz technology, important for 6G achieving 100Gbps on a 10GHz bandwith.

Details emerge about the supercomputer Tianhe Xingyi (Tianhe-3), developed by the National University of Defense Technology despite US export restrictions. May be it is the world's most powerful.

China has 3.2 million 5G base stations, 87 percent of the goal set in the 14th FYP. At the end of 2021, the EU-27 had only 256,000 base stations, according to the EU's 5G Observatory.

Shanghai Lanjian Hongqing Technology Company (link to private rocket maker Landsoft) files with ITU to launch Honghu-III, a network of 10,000 satellites, might be the third Chinese megaconstellation.

Tech progress

- A team from Beijing University of Posts and Telecommunications claims to have built the world's first 6G field network, integrating AI and communication China aims to commercialize 6G technology by 2030, with standards anticipated in 2025. (Source (CN): S&T Daily)

- At the 2024 World Artificial Intelligence Conference in Shanghai, Ant Group, launched its YinYu Cloud platform for privacy-preserving computing of large models. Data owners are so far hesitant to share their data with large models for fear of data leakage. (Source (CN): Leiphone)

- Alibaba Cloud won First Prize in the 2023 China Association for Automation Science and Technology Progress Award for its ultra-large-scale cloud network technology. (Source (CN): Leiphone)

Domestic dynamics

- China is set to launch its G60 Starlink satellite constellation in early August, aiming to deploy 1,296 satellites initially and expand to over 14,000. This state-backed initiative seeks to provide global internet coverage including remote areas and compete with SpaceX's Starlink. (Source (CN): 36kr)

- China's first nationwide survey on data resources, was released on May 24 at a digital economy summit in Fuzhou, Fujian province. The survey suggests that China is underutilizing its data, with less than 3% of data generated last year stored and processed. (Source (EN): SCMP)

Foreign involvement

- Alibaba Cloud announced investments in new, AI-focused data centers in South Korea, Malaysia, the Philippines, Thailand, and Mexico, expanding its global network to 31 regions and 95 availability zones. Alibaba hopes to take a significant market share in the emerging AI cloud market in the Global South. (Source (CN): S&T Daily)

- At the World Mobile Communications Conference in Shanghai in 2024, Huawei announced 5G-A an evolution of 5G, to enhance capabilities in speed, bandwidth, and latency, particularly in high-demand scenarios. (Source (CN): 36 kr)

Latest publications