Biotechnology

China has significantly bolstered its biotechnology sector, prioritizing it in three of the seven cutting-edge science and technology fields in its 14th Five-Year Plan (2021-2025): brain science, genetic engineering, and clinical medicine. Biotech is also crucial to global development goals, particularly in public health, sustainable energy, and food security.

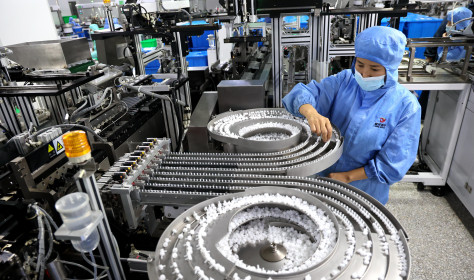

With sizeable domestic support, Chinese companies such as BGI (genome research), Beigene (anti-cancer drugs), Mindray (medical equipment) and WuXi Apptec (services and equipment for drug development) have risen to global prominence.

ChemChina took over Syngenta, the world’s third largest seed producer, in 2017. China is the world’s largest exporter of Active Pharmaceutical Ingredients (APIs).

International collaboration and competition in biotech are intricately intertwined. China participates in roughly a third of the world’s multiregional clinical trials – only the US participates in more. China has also welcomed large investments by multinational pharmaceutical companies in domestic startups. At the same time, fair competition and market access remain a problem for many foreign firms in the healthcare sector, as localization efforts give domestic firms preferential treatment.

Great power competition adds further complexity. China, the US, and Europe all scrutinize the sharing of sensitive genetic and medical data. They also race for supremacy in dual-use technologies, such as brain-computer interfaces, which could be used for military robots.

At a glance

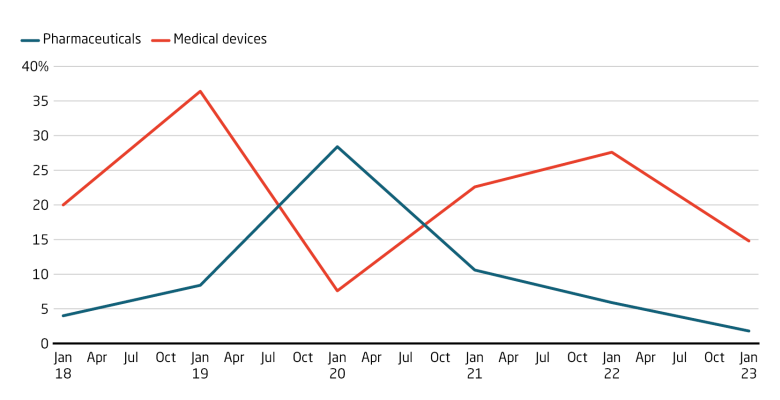

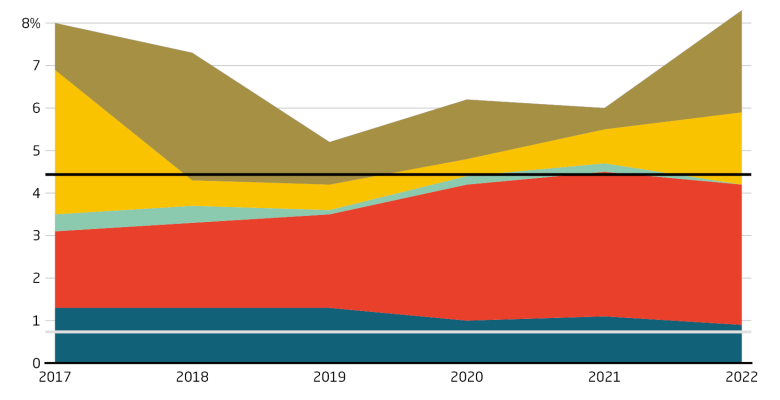

Investment has been pouring into the medical device sector in China, averaging 22 percent in annual growth between 2018 and 2023. Meanwhile, the pharmaceutical sector has averaged ten percent annual growth, with a significant spike at the start of the Covid-19 pandemic. The government’s backing of biotech sectors has channeled both private and public capital into these industries.

In China, companies in the medical devices, in-vitro diagnostics and medical equipment sectors receive significant financial support from the government, equivalent to approximately six percent of company revenue. This is far beyond the usual level of state support provided to firms in OECD countries, which is less than one percent.

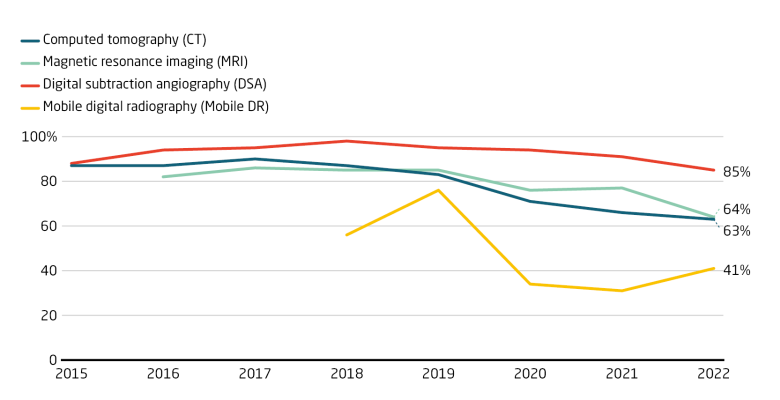

Chinese procurement documents for diagnostic imaging technologies show foreign firms are beginning to cede market share to local competitors. For instance, the share of computed tomography (CT) scanner contracts won by three foreign firms (Siemens, Philips and GE) declined by 24 percentage points between 2018 and 2022. Still, China’s growing healthcare market could boost foreign companies’ revenues in China, even as their market share declines.

Biotechnology in China: Timeline of crucial events

China approves its first COVID-19 vaccine for general public use, developed by state-backed pharmaceutical giant Sinopharm and the Pfizer/BioNTech vaccine was approved for use in the EU.

Chinese medical device company Mindray Bio-Medical Electronics acquires Finnish biotech company HyTest Invest and its subsidiaries for EUR 532 million.

Leading Chinese medical imaging firm United Imaging invests EUR 410 million in a new manufacturing and research facility in Shanghai to rely heavily on automatic and intelligent processes.

The National Development and Reform Commission releases the 14th Five-Year Plan for the bioeconomy, covering life sciences and biotechnologies and calling for more investment in basic research.

MIIT calls for companies to participate in a new biomedical materials innovation program to increase collaborative innovation with a focus on polymer, metal and inorganic non-metallic materials.

MOST issues clarifying rules on human genetic resources, preventing foreign entities from collecting resources in China and restricting their access to them.

AstraZeneca acquired Gracell Biotechnologies for USD 1.2 billion, marking the first time a multinational drugmaker fully acquires a Chinese biotech firm.

The National Healthcare Security Administration aims to enhance coordination between local governments on centralized or volume-based procurement (high volume, low cost purchase of pharmaceuticals).

MIIT issues procurement guidelines, placing restrictions on a wide range of medical equipment, also X-ray machines, MRI & surgical equipment. The rules require 25, 50, 75 or 100 percent local content.

MIIT releases Five-Year Plans for the medical equipment & pharma industries, to ensure basic supplies & improve the industrial chain, enhance pharma innovation, modernization, & supply security 2025.

Chinese healthcare companies such as Andon Health and Beijing Hotgen Biotech see revenue surge thanks primarily to overseas sales of COVID-19 home testing kits.

Fosun Pharma and Genuine Biotech win the right to market the first China-made oral Covid-19 drug. The EU approved the first oral COVID-19 antiviral treatment, Pfizer’s drug Paxlovid, in January 2022.

MIIT releases a three-year plan to develop China’s non-food bio-based materials industry. By 2025, it aims for strong innovation capabilities to broaden its circular economy & reduce carbon emission.

Neusoft Medical launches China's first dual-energy 3.0T magnetic resonance imaging system. Chinese firms can make systems between 1.5T to 3.0T (magnetic field strengths) using only domestic inputs.

Caixin reports: China's outbound deals involving treatment rights exceeded inbound deals for the first time in 2023. Other parties can use a company’s products, technology or intellectual property.

Tech progress

- Chinese scientists have developed the first open-source brain-computer interface chip. The MetaBOC system uses stem cells to cultivate an artificial brain in vitro, which is then linked to an external chip. (Source (CN): S&T Daily, Yicai)

Domestic dynamics

- The Ministry of Science and Technology published ethics guidelines for research on human genome editing. They prohibit research on germline genome editing – i.e. when the genome of an individual is edited to be heritable. (Source (CN): MOST)

- The construction of China's first national-level bio-manufacturing innovation center began in Shenzhen. The center is led by the Shenzhen Institute of Advanced Technology (SIAT) of the Chinese Academy of Sciences and will feature six major technical platforms. (Source (CN): S&T Daily)

- The National Medical Products Administration released the "Management Requirements for the Temporary Import and Use of Urgently Needed Medical Devices by Medical Institutions," aiming to enhance the availability of essential medical devices not yet approved domestically. (Source (CN): NMPA)

Foreign involvement

- The US House Committee on Oversight and Accountability wants to restrict business with Chinese biotech firms like BGI and WuXi AppTec. The Biosecure Act, which still requires approval from Congress, seeks to reduce US reliance on Chinese research and manufacturing. (Source (EN): Reuters)

- Western pharmaceutical companies are increasing licensing deals with Chinese biotech firms, as patents expire. Chinese drugmakers, need international funding due to domestic price cuts. In 2023, biotech licensing deals hit a record USD 44.1 billion, and have continued strongly into 2024. (Source (EN): Financial Times)