Li Hui’s Europe tour 2.0 + Beijing’s mediation as seen from Kyiv + Market distortions

Analysis

Li Hui’s Europe tour 2.0: Shuttle diplomacy for pro-Russian peace

By Grzegorz Stec

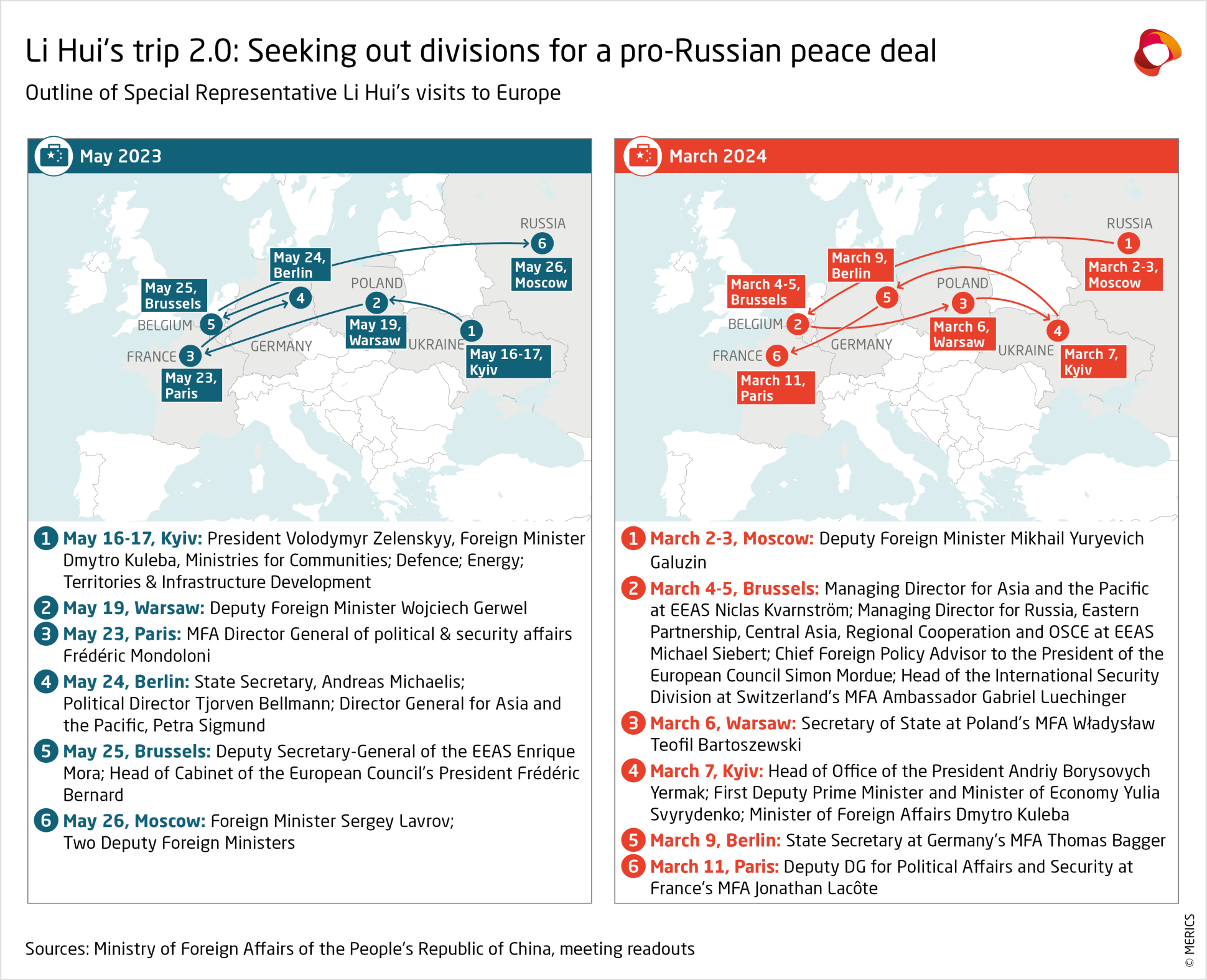

Between March 2 and 11 Li Hui, China's Special Representative on Eurasian Affairs, was back in Europe for round two of shuttle diplomacy aimed officially to “mediate and build consensus” to end the “Ukraine crisis” – Beijing’s euphemism for Russia’s invasion.

In many ways it is déjà vu. In May last year Li toured the same destinations, albeit in a different order, promoting a then recently released position paper from China on the “Political Settlement of the Ukraine Crisis” (often incorrectly referred to as peace plan).

This round of Li Hui’s shuttle diplomacy was about strengthening China’s position and probing the EU’s resolve to find space for a peace formula that would accommodate Russia’s demands – all the while work proceeds for the Swiss-hosted international peace conference in the summer.

Not looking for solutions

The timing and readouts of the visit show that Beijing is not looking to build positive momentum with the EU.

Li’s tour came just two weeks after the EU unveiled its 13th package of sanctions, including against three mainland Chinese companies over their exports of sensitive tech to Russia. While the sanctions only effectively restrict the cooperation of those companies with European entities, targeting companies in mainland China is a significant political gesture and a line that the EU had thus far not crossed.

In direct response, Beijing claimed the EU’s move “violates the consensus and spirit of the China-EU leaders' meeting.” And Li’s exchange with EU officials revealed he was not sent to find solutions but only to rebuke the EU’s actions. The usually upbeat Chinese readouts instead highlighted “China's stern position of firmly opposing the EU's unilateral sanctions and long-arm jurisdiction.”

For context, this move hardly came out of the blue. It followed two distinct events: first the sanctioning of Hong Kong based entities in June last year; and then a clear December communique to China’s leadership at the EU-China summit of intent for further actions should Beijing not take steps to ensure its companies respect EU sanctions on Russia.

Looking for cracks

In light of the impact of US representatives’ waning support for Ukraine, and disagreements over modalities of supporting Ukraine between European capitals, Li’s mission appeared more like a scouting mission for signs of “Ukraine fatigue” among European actors than one seeking consensus. On the sidelines of the National People’s Congress, Wang Yi himself stated that the February Munich Security Conference showed that “more and more people begin to worry about a possible lose-lose outcome, they are ready to create conditions to explore a reliable way out of this crisis.”

And by that, Beijing means moving beyond Zelensky’s conditions for peace – a full withdrawal of Russian troops and restitution of Ukraine’s full territorial integrity. Instead, China’s leadership pushes for “the equal participation of all parties and fair discussions on all peace plans,” opening doors to the question of Ukraine’s territorial integrity.

Talking peace with Beijing

Li’s tour serves as a reminder that China’s approach to the peace process is unlikely to respect international law and the sovereignty of Ukraine. The mediation rhetoric continues to be geared towards amplifying any lingering hopes of constructive Chinese involvement among Europeans and branding China in front of Global South partners as a force for peace and stability in contrast to Washington.

Yet, Beijing continues to enable Russia’s war efforts through providing an economic lifeline, refraining from restricting Chinese companies exports of sensitive technologies to Russia and offering Moscow political platforms, albeit in ways that prioritize China’s interests and keep the political and economic costs low. In line with this, Beijing promotes a vision of peace negotiations that are effectively pro-Russian by putting the aggressor and the victim on an equal footing.

Li’s visit and Beijing’s reaction to EU sanctions, coupled with its pressure during the December summit show that China’s leadership does not intend to acknowledge or take into consideration the invasion-related concerns voiced by the EU. It may be hoping that threading the line on support for Moscow while catering to secondary interests of the EU (through measures such as the extension of visa-free movement) will be enough to contain the fallout from its position on the invasion.

The European capitals seem to be lowering their expectations of China becoming a constructive partner on Ukraine, as exemplified by the lower rank and number of officials that met with Li.

Yet Brussels and other European capitals should be standfast and clear in their position towards China’s communication on the invasion and similarly show the will to continue with punitive measures should Beijing not respect the sanctions. The impact has broader ramifications beyond the war in Ukraine, because if Russia were to ultimately extract concessions from its invasion, it would signal to Beijing for its interests in the Taiwan Strait and in the South China Sea that even a military escalation that is not decisively won on the battlefield, can be translated into concrete gains.

Still, communication with Beijing necessitates striking a balance. That means keeping Beijing’s support for Moscow as constrained as possible, while pushing China to deliver on the constructive points of its own position paper such as ensuring nuclear safety and food security.

Read more:

Prospects for Beijing’s mediation as seen from Kyiv

By Yurii Poita

Kyiv's expectations for China's so-called constructive role appear much lower than before. In 2023, Kyiv believed that opportunities to include China existed on issues where the Ukrainian peace formula intersected with "China's Position on the Political Settlement of the Ukrainian Crisis." For instance, Ukraine asked China to help with the return of forcibly deported Ukrainian children; ensure the functioning of the grain corridor; and help with the withdrawal of Russian troops from the Zaporizhia nuclear power plant.

However, Kyiv's expectations were not fulfilled, and Beijing practically did nothing constructive. On the contrary, in 2024 China's position on many issues worsened: it became the main intermediary for Russia's purchase of semiconductors and components for weapons (up to 75-80 percent); the largest source of CNC machine tools for the Russian defense industry (57 percent in July 2023); strengthened its political, military, economic and technological relations with Russia; and it continued calls to stop arms supplies to Ukraine and start negotiations between Kyiv and Moscow.

After all, an impression exists that Li Hui's 2024 visit comes on the back of significant delays in US military aid to Kyiv, leading to a belief in Beijing that Ukraine and the EU are in a much worse position than before. Therefore, Europe and Kyiv will more likely be ready for negotiations with Moscow, and finally for the acceptance of Russia's ultimatums.

Accordingly, Ukraine is likely not to hold out hope for China's so-called constructive role, but remains ready to continue dialogue with Beijing and try to involve China in establishing a just and stable peace.

Yurii Poita is a European China Policy Fellow at MERICS and Head of the Asia-Pacific Section at the Center for Army, Conversion and Disarmament Studies in Kyiv.

Podcast

Resuming the EU-China people to people dialogue

The high-level EU-China people-to-people dialogue is planned to resume this spring. The last instalment was in 2020, and this podcast episode looks at the relevance and aims of the format and what might be considered a successful outcome.

Claudia Wessling, MERICS Director of Communications and Publications, is joined by Jean-Louis Rocca, Katja Drinhausen and Abigaël Vasselier. Jean-Louis is a professor at Sciences Po University in Paris, and a member of the EU-funded project China Horizons – Dealing with a resurgent China, a project in which MERICS also partakes. Katja is the Head of Program for our Politics and Society research team and Abigaël is a Director for Policy and European Affairs, both at MERICS.

Update

The EU ramps up action against China’s market distortions

On February 16, the European Commission announced the first ever investigation under its 2023 Foreign Subsidies Regulation, targeting a EUR 610 million contract bid of Chinese-built trains, part of a Bulgarian Ministry of Transport and Communication procurement tender. The company, CRRC Qingdao Sifang Locomotive, is a subsidiary of the juggernaut Chinese train manufacturer, the state-owned CRRC. And in the Commission's broader strategy to confront Chinese distortions, Chinese trains are but one aspect of its recent efforts.

What you need to know:

- An innovative foreign-subsidy investigation: As mandated by the new regulation, the Commission has conducted a preliminary review of the competing firms, finding close to EUR 2 billion of PRC state support for the company since 2020. Beyond traditional grants and subsidies, the Commission astutely singled out the absence of competition in public procurement in China as a consequential mechanism of support for CRRC. Those findings mean the most likely result for the investigation will be either an outright ban for CRRC or the company will need to make significant remedy commitments to operate in the single market. Such an outcome would somewhat ease Siemens and Alstom’s frustration over the Commission’s 2019 decision to block their merger.

- The broader China distortions puzzle: On March 6, the Commission announced that its investigation into made-in-China electric vehicles could retroactively impose tariffs upon those imported into the EU customs union from March 1 onwards. This accelerates the process as such a deliberate retroactive period selection was supposed to only be possible after the preliminary assessment expected in July. The Commission has also been supporting European-made solar panels at the March-held EU Energy Council, following February’s failure of European stakeholders to agree on a trade defense approach towards Chinese competitors.

- Still early days: The foreign subsidy regulation – that entered into force in July last year – is yet to be used in the context of services, investments, and acquisitions. In all those fields, state-backed Chinese firms are often significant players in the European market. Similarly, Chinese firms are plausible first targets of the unused August 2022 EU international procurement instrument, because of the limited openness of public procurements in China. In the meantime, the EU still has four open WTO cases against China-originating distortions, from alleged intellectual property infringement to transnational subsidies to made-in-Indonesia steel, with decisions expected this year.

Quick take: The December 2023 EU-China Summit was coined by President von der Leyen as a “summit of choice.” The Europeans listed their multiple grievances to the PRC, among which industrial distortions featured high on the list. Without any clear evolution in China’s policymaking since, it is a matter of credibility for Brussels to turn to autonomous instruments to preserve the level-playing-field within the EU’s single market. After years of massive investments China is under deflation pressures, raising widespread and legitimate concerns of overcapacity. Brussels is ensuring the level-playing-field toolbox it has spent the past decade polishing is up and running. And with a looming election, tackling imports from China becomes an easier sell to member states.

Read more:

- European Council: Foreign Subsidies Regulation: Commission opens investigation

- China Trade Monitor: European Commission Posts Notice of Foreign Subsidies Investigation in Chinese Railcar Procurement

- Science Business: Commission wants to keep the doors open for Chinese solar panel imports

- Reuters: EU set to allow possible retroactive tariffs for Chinese EVs

- ChinaTalk: EU-China Summit: The Quiet Turning Point

Short takes

Xi to visit Paris after Putin visits Beijing

Xi Jinping is expected to travel to Paris in early May for his first EU trip since the onset of the Covid-19 pandemic. However, it seems that the visit will be preceded by Vladmir’s Putin’s trip to Beijing. The sequencing may suggest that Xi could be planning to relay Russia’s points during his trip to Europe rather than vice versa.

China to change its Ambassador to the EU

After fewer than 18 months in Brussels, China’s Ambassador to the EU, Fu Cong, is set to move on to New York to become Beijing’s envoy to the UN. There are still no clear indications as to who his successor will be, but hopefully the interim period will not be as long as the year it took for Fu Cong to arrive following his predecessor’s departure.

- Bloomberg: China’s EU Envoy to Depart Brussels for UN in Diplomat Shuffle

- MERICS: Fu Cong – China’s new Ambassador to the EU

Visa easing for six more European countries

On the sidelines of the National People’s Congress, Foreign Minister Wang Yi announced an extension of China’s visa exemption scheme to six additional European countries: Austria, Belgium, Hungary, Ireland, Luxembourg, and Switzerland (on the back of France, Germany, Italy, the Netherlands, and Spain). The scheme, active until November 30, allows visa-free visits of up to 15 days. The moves are likely an attempt to revive China’s tourism industry and prepare the ground for the EU-China High-Level People-to-People Dialogue expected to take place in the coming months.

- People’s Daily: China announces visa-free policy for 6 European countries: FM

- MERICS: Resuming the EU-China people to people dialogue, with Jean-Louis Rocca, Katja Drinhausen and Abigaël Vasselier

The anti-forced labor regulation is a done deal

On March 5, the European Parliament and Council reached an agreement. Avoiding the bumpy fate of the recent Corporate Sustainability Due Diligence Directive (CSDD), the anti-forced labor text received approval on March 13, albeit with ten countries abstaining. Contrary to the CSDD, this regulation does not create additional obligations for firms, but establishes the possibility of a ban of products made with forced labor in their value chains. If the regulation applies to both domestic and foreign markets, China and the well-documented abuses of Uyghur labor appear as the main target. With the formal approval by the European Parliament anticipated in April, bans could materialize as soon as 2025.

- European Council: Council and Parliament strike a deal to ban products made with forced labour

- MERICS: China and the Red Sea crisis + EU anti-forced labor instrument

The European way of regulating TikTok

On February 19, the European Commission opened a formal investigation into the Chinese social media giant for a flurry of breaches of the Digital Service Act, the second such investigation after that of X (formerly Twitter) in December. TikTok has failed to convince the Commission that it protects minors, advertises transparency, makes data accessible for researchers, or prevents addictive design and harmful content. In March, TikTok was also the target of a EUR 10 million fine by Italian authorities for failed content monitoring, while the head of the French military recently characterized it as “a new type of informational warfare device.” As an outright forced sale is looming in the US, the Europeans are doing it their way; regulate, regulate, regulate.

- European Council: DSA: Commission opens formal proceedings against TikTok

- Autorita' Garante della Concorrenza e del Mercato: TikTok sanctioned for an unfair commercial practice

The European People’s Party manifesto supports de-risking relations with China

The manifesto called the party’s general approach towards China to be to “de-risk, not decouple” and need for a “long-term strategy,” echoing President von der Leyen’s agenda. This gives her – as the EPP’s candidate for the next head of the Commission – a party mandate to complete the implementation and ensure the success of “de-risking” in a potential second term. China seems high on the agenda – appearing 11 times across the document (compared to Russia’s ten and the US’ six mentions) – with references to regional tensions in the South China Sea and Taiwan, economic and tech competition, national security concerns regarding critical infrastructure and to “foster a special cooperation with like-minded partners in a Union of Democracies” to compete with China.