China’s digital platform economy: Assessing developments towards Industry 4.0

Challenges and opportunities for German actors

Executive Summary

China’s digital platform economy will determine its industrial future

China’s leadership has set an ambitious deadline to become a superpower in science and technology innovation by the 100th birthday of the People’s Republic in 2049. The digitalization of industrial production is central to their ambition. Digital platforms in the manufacturing sector are considered crucial to upgrade industry, improve productivity, optimize resource allocation and increase employment.

Other countries can benefit, especially Germany, with its strong industrial base and rich experience in the realm of “Industrie 4.0”. German companies like Siemens, SAP and Bosch are already engaged in China’s emerging digital industrial platforms economy. However, European actors must brace themselves for challenges. The competition is on: China will be a major contestant in the “battle for industrial data”, as EU Commissioner Thierry Breton recently coined the new phase of digitalization, in which Europe hopes to gain a stronger foothold after being outperformed by US and Chinese tech companies.

China’s push into the digital platform economy

China is investing heavily to become a leader of the Fourth Industrial Revolution; spending on IT technologies reached CNY 2.6 trillion (EUR 337 billion) in 2018, research and advisory firm Gartner has estimated. Software and data center systems accounted for CNY 250 billion (EUR 32 billion) of this. Government policy pressure will see more companies invest in the Internet of Things. Market observers estimate that China will account for one third – 4.1 billion – of global Industrial IoT connections (IIoT) by 2025.

Chinese digital industrial platforms are starting to compete on a global level. One of the most important is INDICS, set up by China Aerospace Science & Industry Corporation Limited (CASIC), a state-owned missile manufacturer under direct central government control. Two other corporate giants have set up increasingly influential platforms: Haier, the appliances and electronics manufacturer, and Alibaba, the internet retail giant.

The strategic context: Digital platforms are considered crucial for industrial modernization

China’s promotion of the digital platform economy sits within an ecosystem of major policy initiatives, Internet+, Made in China 2025 and China Standards 2035, an effort to standardize cutting-edge technologies, e.g. AI, cloud computing, IoT and big data. The digital platform drive combines corporate initiatives from China’s internet giants with the state-led push to integrate traditional industries using advanced information and communication technology (ICT).

The scarcity of advanced manufacturing in China is a key reason for the gulf between industrial digitalization and flourishing consumer oriented service platforms such as video-sharing hub TikTok, the e-commerce portal Taobao and Tencent’s WeChat ecosystem: the enterprise-on-cloud rate in China was only 30.8 percent in 2018, compared to 50 percent in the US and 73 percent in Germany, all reported for 2018, according to a Chinese survey.

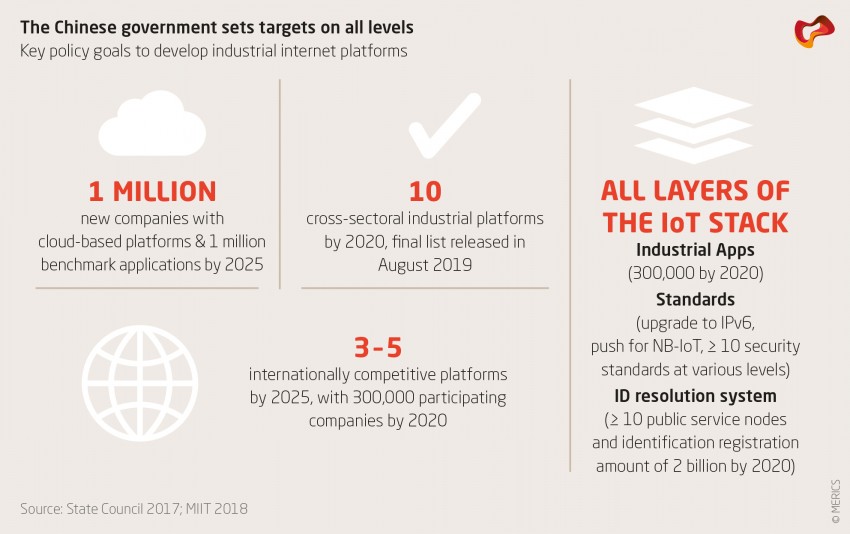

Government targets aim to remedy these deficiencies: policymakers want to see one million companies “go cloud”, a crucial prerequisite for utilizing digital platforms. Bold targets to foster platform development include the establishment of one leading global digital industrial platform, 10 cross-sectoral platforms and 300,000 industrial apps by 2020. Policymakers’ top-down approach combines ambitious, regularly adjusted targets with selected pilot projects to pressure industrial and ICT actors to fulfill policy goals.

The actors: Top-level design drives a highly coordinated industrial internet development program

The main player orchestrating digital industrial platform development is the Ministry of Industry and Information Technology (MIIT). In 2018, MIIT published its first ever list of 93 industrial internet projects in a comprehensive effort to build, scale up, regulate and standardize China’s platforms. The Ministry of Finance (MOF) funded the first batch of projects with CNY 4.9 billion (EUR 679 million).

MIIT presides over the Alliance of the Industrial Internet (AII), the major forum for interaction between policy makers and industry. The AII was created in 2016 and has more than 1,300 members. The AII’s few foreign members include SAP, Siemens, Schneider Electric and GE. The body is active in setting technical standards for China’s industrial internet platforms.

State-owned enterprises (SOEs) are tasked with generating sector-specific platforms. For instance, a unit of oil giant Sinopec has set up a platform for the petrochemical industry.

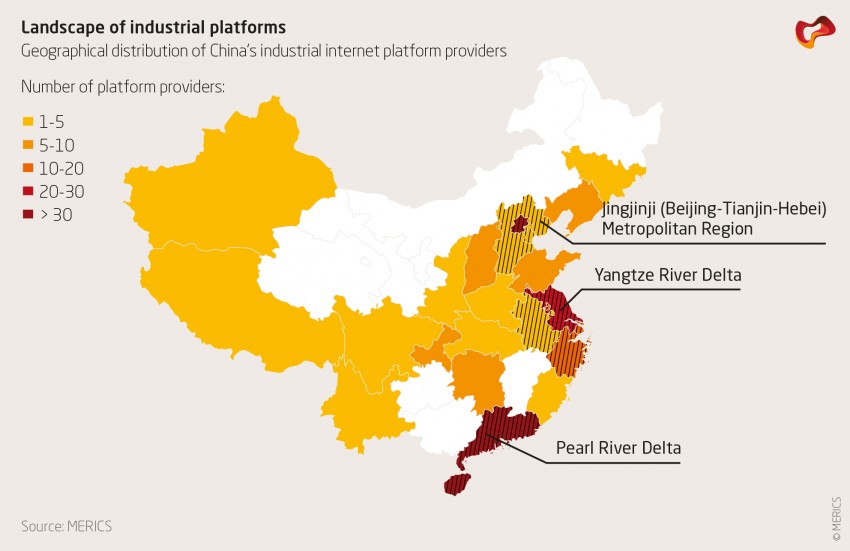

The result: A state-led industrial platform landscape is emerging fast

Three push factors are combining to shape the industrial digital platform landscape: government strategy is driving work by giant SOEs in key sectors; private sector firms have joined in; and ICT giants are venturing into B2B to counteract stagnating user growth in their B2C strongholds.

The Industrial Internet Convergence Platform for Centrally Administered State-owned Enterprises was founded in June 2019 with 289 SOEs, including giants like China State Shipbuilding Corporation, Baosteel (partnered with Siemens since 2015) and oil major Sinopec’s unit Petrochemical Yingke. Several set up cloud platforms intended to optimize collaborative R&D and manufacturing.

Among the most successful private sector players, Haier’s COSMOPlat combines 12 industries from textiles to electronics and ceramics and claims to serve 35,000 companies with 320 million end-users. ICT companies like Alibaba, Tencent, Huawei and Baidu seek to leverage data from a massive pool of internet users: using consumer behavior data to optimize industrial design and production is a core feature of Industry 4.0.

Some Chinese ICT players will benefit from their strength in cutting-edge applications. Baidu’s Apollo, the world’s first open-source autonomous vehicle technology platform, has over 130 corporate partners, including major German carmakers.

The caveat: China lacks core capabilities for platform development

Nonetheless, China’s own analysts openly debate weaknesses in this mass of activity. Their views are consistent with MERICS own research. China’s structural dependence on key foreign components like industrial software is a fundamental deficiency that provides opportunities for foreign companies.

China lacks indigenous solutions in key layers of the industrial internet platform architecture, e.g.:

- Sensors: the PRC has to import almost 80 percent of high-end sensors and up to 90 percent of chips to meet domestic demand.

- Device connection: in 2019, 95 percent of high-end programmable logic controllers (PLC) and common industrial protocols were imported. Lack of interoperability with devices from different foreign companies is also an issue.

- Software as a service (SaaS): over 90 percent of high-end industrial software used in China is of foreign origin. Companies like SAP, Microsoft and Salesforce dominate the market.

China’s solutions: Setting standards and strategies to resolve domestic weaknesses

China’s government has begun to tackle shortcomings with centrally devised implementation blueprints. Key implementation mechanisms are:

- Devising region-specific, sub-national pilot projects involving local governments, state-owned companies and private firms (such as Alibaba’s SupET in Zhejiang, CASICloud in Guizhou or XCMG’s XREA in selected BRI countries)

- Experimentating with more market-driven funding mechanisms, including private equity investment, to reduce the dominance of state subsidies

- Devising a comprehensive industrial internet standardization system by 2020.

Obstacles to Chinese companies engaging in the IIoT include the lack of interoperability standards and insufficient rules on data ownership and security. China’s regulators therefore want more robust technical standards and a basic industrial internet standardization system by 2020.

Most of China’s 324 industrial internet standards are still awaiting formulation. The AII has judged platform standardization work in China as “early stage”. Standardization is an area in which foreign actors could and should engage with China.

Conditional partners: Foreign participation depends on China’s technological needs

China’s official rhetoric proposes an open digital platform economy that is cross-border and “win-win” in nature. It is not currently pushing for outright self-sufficiency, or a model decoupled from developments in other countries that would result in the exclusion of foreign actors.

Many digital platforms analyzed in our study have benefited from strategic partnerships with foreign companies like Siemens, Bosch, SAP or GE and foreign research. Even so, China’s constant theme is the need for strong domestic capabilities that advantage its firms vis-à-vis foreign competitors.

Our observations suggest that foreign players have limited ability to influence regulatory developments. The environment favors indigenous solutions in the digital platform economy. Cybersecurity and data regulations are likely to be the main challenges for foreign companies doing business with China in the digital platform economy.

The implications for Germany: exploring opportunities and mitigating risks

Germany is a key partner for China in developing an Industry 4.0 of its own. German companies and institutions play an important facilitating role in China’s work to create digital industrial platforms, with joint research and development projects the main form of cooperation. E.g.:

- The R&D institute behind Haier’s COSMOPlat has cultivated strong links with several German research institutes.

- Siemens gave support to the development of CASICloud’s INDICS cloud platform from early on.

Opportunities for German platform providers to offer services to Chinese customers are far more limited. However, they could arise in the areas of use and integration of sensors, device connection and “software as a service” solutions.

China’s rapid advance in the realm of digital industrial platforms demands attention from German political and corporate actors on various levels. Germany should not delay mitigating potential risks.

Recommendations for German actors revolve around three areas

- Learning from China’s strengths. This requires, among other things, a solid understanding of China’s overall innovation capacity, going beyond showcase projects. A realistic assessment of the overall impact of China’s digital platform economy needs more research on regional specifications and development stages.

- Conditional cooperation with China to leverage German strengths. China is highly dependent on foreign IIoT stack components and services. German actors can use this to demand greater transparency in the application of cybersecurity regulations and equal access to the market for foreign companies. At the same time, maintaining a high level of cooperation on Industry 4.0 is in Germany’s interest.

- Mitigate risks arising from China’s idiosyncratic policy environment. China’s drive to achieve self-reliance in every layer of the industrial internet creates challenges for German partners. Joint research needs to be conditionalized and IP protection needs to be a key priority in setting up cooperation frameworks.

This MERICS study is based on a deep search and analysis of primary Chinese language sources with data as of December 2019. We made a systematic analysis of official policy documents since 2015, Chinese experts’ research papers and interviews with and feedback from 25 experts from politics, the corporate sector and research institutions.